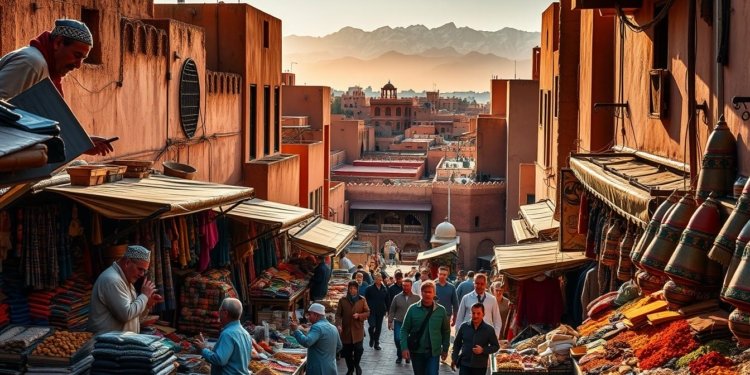

Why are more U.S. entrepreneurs and investors turning to Morocco for new opportunities? With its strategic location connecting Europe and Africa, Morocco offers a dynamic market with growing industries like tourism, renewable energy, and agriculture.

The country’s business-friendly policies, including tax incentives and a streamlined registration process, make it an attractive destination. Setting up a company typically takes between one and four weeks, depending on the legal structure.

This guide breaks down a 10-step framework to help you navigate the process smoothly. From cultural considerations to key industries, we cover everything you need to know.

Key Takeaways

- Morocco serves as a strategic hub between Europe and Africa.

- Key industries include tourism, agriculture, and renewable energy.

- Company registration usually takes 1-4 weeks.

- Tax incentives and cultural awareness are crucial for success.

- Local networks and compliance with labor laws enhance business stability.

Why Morocco Is a Strategic Location for Your Business

Strategic advantages make Morocco a hotspot for foreign investment and expansion. Its position as a bridge between Europe and Africa offers unmatched trade access. Free trade agreements with the U.S. and EU further boost its appeal.

Growing Economy and Key Industries

Morocco’s economy grew by 4.3% in 2023, outpacing many regional peers. The automotive sector contributes $14 billion annually, making it Africa’s second-largest car exporter. Cities like Casablanca and Rabat are emerging as tech hubs, attracting global talent.

Renewable energy is another standout, with 42% of electricity from solar and wind. The Noor Ouarzazate complex, the world’s largest solar farm, underscores this leadership. Government incentives in special economic zones reduce costs for investors.

Key industries driving growth include:

- Tourism: 12% of GDP, fueled by cultural heritage and coastal resorts.

- Agriculture: Employs 13% of workers, with citrus and phosphates as top exports.

- Textiles: $3.4 billion in exports, supported by skilled labor.

With a young, multilingual workforce and pro-business policies, Morocco is ideal for scaling ventures across sectors.

How to Start a Business in Morocco: Key Steps

Finding the right venture in Morocco begins with solid research. The country’s diverse economy offers niches from tourism to tech, but success hinges on aligning your business idea with local demand.

Identifying a Profitable Business Idea

Morocco’s 36 million consumers create opportunities across sectors. Validate your concept using these steps start with market gaps:

- Analyze trends via Google Trends or SEMrush.

- Review CRI’s market reports for industry insights.

- Study case studies like Healthy Chew’s $1.8M meal prep service.

Conducting Market Research

Local preferences shape success. For example, coastal regions favor tourism ventures, while cities demand tech solutions. Tools like demographic dashboards highlight spending habits.

Competitive analysis reveals pricing norms and untapped niches. Pair this with cultural insights to refine your start business strategy.

Developing a Winning Business Plan

A well-structured business plan is your roadmap to success in Morocco’s competitive market. It clarifies goals, attracts investors, and aligns operations with local regulations. The Moroccan Investment Center (CRI) mandates key elements like 5-year financial projections and partnership strategies.

Essential Components to Include

Start with a SWOT analysis to identify strengths, weaknesses, and market gaps. Include detailed financial models accounting for dirham conversions and currency risks. Case studies, like a tourism agency’s permit process, reveal practical hurdles.

Critical sections:

- Financial projections: Outline capital needs and revenue streams.

- Local partnerships: Leverage Morocco-EU trade agreements for cost savings.

- Risk assessment: Address currency fluctuations and regulatory changes.

Tailoring Your Plan for the Moroccan Market

Adapt operations using a cultural checklist—hospitality norms impact service products. Localized marketing plans should incorporate multilingual campaigns and regional preferences. For example, coastal areas favor tourism ventures, while cities demand tech solutions.

Pro tip: Use Morocco’s renewable energy incentives to reduce operational costs. Align your development timeline with government grant cycles for maximum benefit.

Choosing the Right Legal Structure

Your venture’s legal structure determines liability, taxes, and operational flexibility. Morocco offers several company formats, each with unique requirements and benefits. Matching your goals to the right framework minimizes risks and maximizes growth potential.

Comparing Sole Proprietorships, LLCs, and More

The SARL (Morocco’s LLC) requires just 10,000 MAD capital and suits small to mid-sized ventures. For larger projects, the SA (Public Limited Company) demands 300,000 MAD but offers shareholder flexibility. Auto-entrepreneurs register in 72 hours—ideal for freelancers.

Key types of legal structures:

- SARL: Limited liability, 2+ shareholders, low capital.

- SA: Higher capital, suits investors and public offerings.

- Auto-entrepreneur: Fast setup, unlimited liability.

Tax and Liability Implications

SARLs shield personal assets but require social security contributions. SAs face stricter governance but benefit from tax incentives in special economic zones. Foreign ownership is restricted in sectors like media and defense.

Notarizing articles of association is mandatory for SARLs and SAs. A tech startup might choose an SARL for its balance of protection and simplicity, while a multinational opts for an SA to attract capital.

Navigating the Company Registration Process

Registering a company in Morocco involves clear steps and precise documentation. The government has simplified procedures to encourage foreign investment, but adherence to legal requirements remains critical. Proper preparation reduces delays and ensures compliance.

Required Documents and Fees

Prepare translated and legalized copies of identity documents, Articles of Association, and proof of address. A Certificat Négatif (negative certificate) costs 126–210 MAD and validates your company name within three business days.

Key expenses include:

- 400 MAD base fee + 1% of share capital for registration.

- 4–9.6 MAD per line for official publication in the Bulletin Officiel.

- 5,000–15,000 MAD for accountant-assisted CRI submissions.

Working with the Regional Investment Center (CRI)

The CRI streamlines approvals and offers online portals for submissions. Non-residents need a power of attorney if unable to attend in person. Common rejections stem from incomplete forms or unpaid fees—double-check all fields.

Post-registration, enroll in the CNSS social security system. Industry-specific permits (e.g., tourism licenses) may require additional steps. Partnering with local experts accelerates the work process and avoids bureaucratic pitfalls.

Opening a Business Bank Account in Morocco

Managing finances effectively is crucial for any venture in Morocco. A dedicated bank account streamlines transactions, ensures compliance, and simplifies tax reporting. Foreign entrepreneurs should prepare for varying deposit requirements and documentation.

Banking Requirements for Foreigners

Non-residents need a residency card and notarized company documents to open bank account options. Attijariwafa Bank requires a $2,500 minimum deposit, while BMCE Capital mandates $5,000. Convertible dirham accounts allow multi-currency transactions, ideal for international trade.

Essential documents include:

- Certified articles of association and trade register extracts.

- Tax identification (ICE) and manager identity proofs.

- Specimen signatures and legal announcement copies.

Tips for Selecting the Right Bank

Compare online banking features—BMCE offers robust platforms for transfers and balance checks. SWIFT transfers incur high fees, so negotiate rates with relationship managers. Case studies show e-commerce firms benefit from Arab Bank’s multi-currency solutions.

Prioritize banks with English-speaking staff and proximity to your office. Pro tip: Use bank advisors to clarify agreements and avoid hidden charges.

Securing a Workspace: Office or Remote?

Morocco offers flexible workspace solutions for modern entrepreneurs. Whether you prefer a traditional office or a remote setup, understanding local norms ensures compliance and cost efficiency.

Local Regulations for Physical Locations

Leasing commercial space requires adherence to zoning laws. Contracts often include 6–24-month grace periods for startups. Verify permits for utilities like electricity, which take 5–10 days to activate.

Key considerations:

- Negotiate lease terms to include maintenance clauses.

- Impact Hub Casablanca provides coworking solutions with high-speed internet.

- Ensure your location aligns with municipal codes to avoid fines.

Cost Expectations by City

Rent varies widely. Casablanca averages $18–$35/m², while Marrakech ranges $12–$22/m². Coastal hubs like Taghazout attract digital nomads with coliving spaces like SunDesk, offering ocean views and community support.

Remote workers can apply for Morocco’s Digital Nomad Visa, valid for one year. Budget $1,500–$2,000 monthly for accommodation and reliable internet. Global eSims or local SIM cards (20 MAD for 5GB) keep you connected.

Hiring and Training Employees in Morocco

Building a strong team in Morocco requires understanding local labor dynamics. The country offers a skilled, multilingual workforce, but compliance with regulations and cultural norms is key to success.

Labor Laws and Social Security (CNSS)

Employers contribute 8.98% to CNSS, while employees pay 4.29%. Mandatory benefits include 18 days of annual leave and overtime pay at 125–150% of regular wages.

Termination rules vary by contract type. Fixed-term roles require 15 days’ notice, while permanent staff must receive 30–90 days. Benchmark employee benefits like health coverage to stay competitive.

Cultural Considerations for Team Management

Respect for hierarchy and trust-building are vital. Non-verbal cues, like avoiding direct eye contact with seniors, matter. Training programs should cover:

- Local communication styles (indirect feedback preferred).

- Religious holidays (e.g., Ramadan adjustments).

- Team-building activities to foster rapport.

Platforms like ReKrute specialize in local talent, while Indeed.ma reaches broader audiences. Balance cost savings with work-life balance expectations to retain top performers.

Understanding Morocco’s Tax System

Navigating Morocco’s tax landscape is essential for financial success. The system blends competitive rates with incentives to attract global ventures. Whether you’re a startup or an established firm, strategic planning optimizes liabilities and compliance.

Corporate Tax Rates and VAT

Corporate tax rates range from 10% to 31%, depending on profits and sector. Export-focused industries often qualify for lower brackets. VAT follows a tiered structure:

- 20% standard rate for most goods and services.

- 10% for hotels and tourism-related activities.

- 0% for agricultural products and essentials.

Exporters can reclaim VAT by submitting transaction records to the tax authority. Digital services face a 5% levy, impacting e-commerce platforms.

Tax Incentives for Foreign Investors

Morocco offers tax incentives to boost foreign investment. Special economic zones provide 5-year exemptions for qualifying companies. The U.S.-Morocco double taxation treaty prevents dual liabilities on income.

Key strategies for SMEs:

- Structure operations to benefit from renewable energy subsidies.

- Leverage free trade agreements to reduce import taxes.

- Maintain audit-ready records, including transfer pricing documentation.

Case in point: An automotive supplier in Tangier saved 15% annually through zone-based incentives. Always consult local experts to align with evolving regulations.

Marketing Your Business to Moroccan Consumers

Morocco’s consumer market thrives on cultural authenticity and digital engagement. With 75% of the population active on Facebook, blending online and offline strategies is essential. Tailoring campaigns to local values ensures deeper connections with your audience.

Local vs. Digital Marketing Strategies

Traditional media like TV and radio still hold sway, especially in rural areas. However, digital platforms dominate urban centers. Allocate budgets wisely—social ads outperform TV for Gen Z, while older demographics trust print.

Influencer partnerships cost 5,000–20,000 MAD per post but yield high ROI. Platforms like Instagram and TikTok drive 30% of e-commerce traffic. Case in point: Jumia.ma boosted sales by 40% using localized Arabic ads.

Language and Cultural Nuances

Moroccans prefer products marketed in French or Darija (Moroccan Arabic). Visual content outperforms text-heavy ads—30% of successful campaigns use carousels or videos. Ramadan requires special planning; launch promotions 2–3 months early.

Key tactics for trust-building:

- Highlight after-sales services to reassure buyers.

- Feature local testimonials to humanize brands.

- Use payment gateways like CMI or PayPlug for seamless checkouts.

Register trademarks early to protect your brand in this growing country. The process takes 6–8 weeks and costs ~2,500 MAD. Align campaigns with cultural events like Eid for maximum impact.

Top Industries for Entrepreneurs in Morocco

Several key sectors drive Morocco’s economic growth and attract global investors. From tourism to renewable energy, these industries combine innovation with cultural heritage. Strategic government policies further enhance their potential.

Tourism and Hospitality

Tourism contributes $8 billion annually to Morocco’s economy. Coastal resorts like Agadir and historic cities such as Marrakech draw 13 million visitors yearly. Boutique riads and eco-lodges cater to luxury and sustainable travel trends.

Women-led cooperatives, like Dar Si Hmad, showcase community-based tourism. High-speed rail expansions improve accessibility between major hubs. Film production incentives also boost location-based revenue.

Renewable Energy and Technology

Morocco aims to generate 52% of its power from renewables by 2030. The Noor Ouarzazate solar farm, the world’s largest, underscores this commitment. Tech hubs in Casablanca and Rabat foster startups in fintech and AI.

Investors benefit from tax breaks in special economic zones. Agri-tech innovations, like drip irrigation systems, merge sustainability with profitability. The Tangier automotive cluster exemplifies industrial modernization.

Textiles and Agriculture

Textile exports hit $3.4 billion, supported by skilled labor and EU trade deals. Organic cotton and argan oil products dominate niche markets. Cannabis legalization opens new avenues for medicinal exports.

Agriculture employs 13% of workers, with citrus and olives as top exports. Cooperatives empower rural women, blending tradition with entrepreneurship. Climate-resistant crops are a growing focus for agribusiness.

Unique Business Ideas for the Moroccan Market

Innovative concepts thrive in Morocco’s diverse economy. From hospitality to digital services, untapped niches offer high growth potential. Here are three proven business idea models to consider.

Bed and Breakfasts for Tourists

Morocco’s tourism boom fuels demand for authentic stays. Converting a family riad into a B&B cuts startup costs. Platforms like Airbnb simplify marketing, while local cuisine and cultural tours enhance guest experiences.

Key considerations:

- Renovation budgets average $15,000–$30,000 for traditional decor.

- Coastal towns like Essaouira attract year-round visitors.

- Partner with tour operators for bundled packages.

Meal Prep and Delivery Services

Urban professionals seek convenient, halal-compliant meals. Subscription models generate up to $600,000 monthly. Healthy Chew’s success proves demand for diet-specific kits.

Strategies for scaling:

- Offer gluten-free or keto options to stand out.

- Use Instagram ads to target Casablanca’s busy workforce.

- Cloud kitchens reduce overhead vs. brick-and-mortar.

E-Commerce and Online Courses

Morocco’s e-commerce market grew 22% annually since 2020. Sell handmade crafts or launch Arabic-language courses—both show 300% revenue spikes. Payment gateways like CMI ensure smooth transactions.

Top niches:

- Digital nomad guides for remote workers.

- Argan oil skincare via Shopify stores.

- Coding bootcamps tailored to Francophone learners.

Leverage Morocco’s multilingual talent to create content. Test ideas with low-cost prototypes before scaling.

Cultural Differences in Moroccan Business Practices

Understanding cultural nuances in Morocco can make or break your professional relationships. Over 72% of deals require face-to-face meetings, emphasizing the importance of personal connections. Adapting to local customs ensures smoother collaborations and long-term success.

Communication Styles and Expectations

Moroccans value indirect communication to maintain harmony. Avoid blunt refusals—polite deflection is common. Meetings often begin with casual chats about family or travel.

Business cards should feature French or Arabic translations. Present them with the translated side facing the recipient. Use your right hand, as the left is considered unlucky.

Fridays are reserved for prayers, so schedule meetings outside 11:15 a.m.–3 p.m. Gaining local experience builds trust, which is essential before discussing contracts.

Negotiation and Pricing Norms

Haggling is expected, even in B2B transactions. Initial quotes often leave room for negotiation. Rushing decisions is seen as disrespectful—patience is key.

Gifts like pastries or flowers are appreciated when invited to a home. Avoid alcohol unless certain it’s acceptable. Non-verbal cues, like moderate eye contact, convey respect.

Your location impacts dynamics. Coastal cities are more relaxed, while Casablanca follows faster-paced norms. Collaborative work styles bridge cultural gaps effectively.

Common Challenges for Foreign Business Owners

Foreign entrepreneurs in Morocco often face unexpected hurdles despite the country’s business-friendly policies. From language gaps to bureaucratic delays, preparation is key to overcoming these obstacles.

Language Barriers and Solutions

Morocco’s multilingual landscape (Arabic, French, Berber) complicates communication. Legal requirements mandate certified translations for contracts and permits. Hiring an approved translator speeds up processes like tax filings or lease agreements.

Local partners or bilingual staff bridge gaps in negotiations. Case in point: A tech startup reduced approval times by 40% after hiring a Darija-speaking project manager.

Navigating Bureaucracy

Paperwork delays affect 58% of foreign ventures. “Facilitateurs agréés” (accredited facilitators) help navigate registrations and customs clearance. Their experience with Moroccan ministries minimizes rejections.

Critical steps include:

- Notarizing documents with a Moroccan notary.

- Publishing company details in the Bulletin Officiel.

- Vetting local partners to avoid compliance risks.

Streamlined investment approvals now take 30 days, but patience and local expertise remain vital.

Costs to Expect When Starting Your Business

Launching a venture in Morocco involves careful financial planning. Initial investments vary widely based on industry, location, and legal structure. Understanding both visible and hidden expenses helps maintain budget control.

Breaking Down Initial Setup Costs

Startup capital ranges from $5,000 for small businesses to $50,000 for larger operations. Key expenses include:

- Legal fees: 5,000–15,000 MAD for registration assistance.

- Office space: 4,000–15,000 MAD monthly in prime areas.

- Equipment: 3,000–8,000 MAD per workstation.

Utility deposits often equal 3–6 months of estimated usage. Special permits, like food safety licenses, add 2,000–5,000 MAD. Always confirm cost details with local authorities.

Managing Recurring Monthly Expenses

Ongoing operational costs impact cash flow. Accounting services average 500–1,000 MAD per month, plus 700–2,000 MAD annually for filings. Employee onboarding requires CNSS contributions of 13.27% of salaries.

Digital marketing budgets start at 1,000 MAD monthly. Website maintenance adds 500–2,000 MAD. Unexpected fees like municipal taxes or renewal charges can surface—allocate a 10–15% buffer.

Smart Strategies to Reduce Financial Risks

Mitigate currency fluctuations by maintaining foreign currency accounts. Emergency funds covering 3–6 months of operations provide stability. Case studies show coworking spaces cut office costs by 40% during early stages.

Negotiate vendor contracts annually for better rates. Leverage free trade zones for tax savings on imports. Always verify final invoices against quoted prices to avoid overpayment.

Conclusion

Morocco’s dynamic economy presents exciting opportunities for global entrepreneurs. From market research to legal setup, each step ensures a smooth entry into this thriving market. Cultural adaptation remains vital for long-term success.

Key sectors like tourism, renewables, and tech show strong growth projections. Leverage resources from the CRI to streamline registrations and permits. Their expertise simplifies navigating local regulations.

For those ready to start business morocco, professional consultations save time and reduce risks. Stay updated on upcoming regulatory changes to maintain compliance. Morocco’s blend of tradition and innovation makes it a prime destination for ambitious ventures.

FAQ

What are the best industries for starting a business in Morocco?

Tourism, renewable energy, textiles, and agriculture are thriving sectors. E-commerce and digital services also show strong growth potential.

Can foreigners open a business bank account in Morocco?

Yes, with a valid passport, residency proof, and company registration documents. Banks like Attijariwafa and BMCE offer services for foreign entrepreneurs.

How long does company registration take?

Typically 2–4 weeks if documents are complete. The Regional Investment Center (CRI) streamlines the process for foreign investors.

What’s the corporate tax rate for businesses?

Standard rates range from 10% to 31%, with incentives for sectors like renewable energy and export-oriented industries.

Is knowledge of Arabic or French mandatory?

While not legally required, fluency in French helps with bureaucracy. English is gaining traction in tech and tourism sectors.

Are there tax incentives for startups?

Yes, exemptions exist for the first 5 years in certain zones, along with reduced VAT rates for eligible activities.

What’s the average cost of office space in Casablanca?

Expect – per sqm/month in prime areas. Shared workspaces offer flexible options from 0/month.

Do I need a local partner to launch a business?

Only for specific sectors like import/export. Most industries allow 100% foreign ownership.

How does Morocco’s location benefit businesses?

Proximity to Europe and Africa, plus free-trade agreements, make it a hub for logistics and manufacturing.

What’s the minimum capital required for an LLC?

No minimum for SARL (LLC), but some banks may require an initial deposit of ~

FAQ

What are the best industries for starting a business in Morocco?

Tourism, renewable energy, textiles, and agriculture are thriving sectors. E-commerce and digital services also show strong growth potential.

Can foreigners open a business bank account in Morocco?

Yes, with a valid passport, residency proof, and company registration documents. Banks like Attijariwafa and BMCE offer services for foreign entrepreneurs.

How long does company registration take?

Typically 2–4 weeks if documents are complete. The Regional Investment Center (CRI) streamlines the process for foreign investors.

What’s the corporate tax rate for businesses?

Standard rates range from 10% to 31%, with incentives for sectors like renewable energy and export-oriented industries.

Is knowledge of Arabic or French mandatory?

While not legally required, fluency in French helps with bureaucracy. English is gaining traction in tech and tourism sectors.

Are there tax incentives for startups?

Yes, exemptions exist for the first 5 years in certain zones, along with reduced VAT rates for eligible activities.

What’s the average cost of office space in Casablanca?

Expect $15–$30 per sqm/month in prime areas. Shared workspaces offer flexible options from $100/month.

Do I need a local partner to launch a business?

Only for specific sectors like import/export. Most industries allow 100% foreign ownership.

How does Morocco’s location benefit businesses?

Proximity to Europe and Africa, plus free-trade agreements, make it a hub for logistics and manufacturing.

What’s the minimum capital required for an LLC?

No minimum for SARL (LLC), but some banks may require an initial deposit of ~$1,000 for account opening.

,000 for account opening.