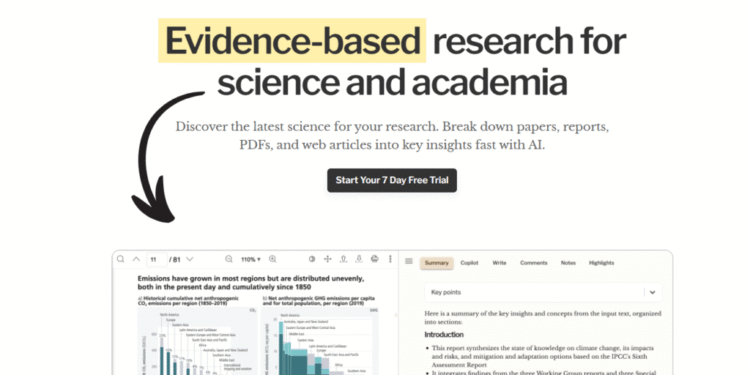

What if your business could predict market shifts before they happen? Imagine having a system that transforms raw information into strategic advantages instantly.

Many companies struggle with overwhelming amounts of information. They miss opportunities hidden in their own records. Traditional tools often fail to deliver real-time actionable intelligence.

Our platform changes everything. It delivers cutting-edge artificial intelligence designed specifically for business transformation. The system provides actionable insights that help organizations make data-informed decisions instantly.

Built with enterprise-grade security from the ground up, it ensures complete protection of sensitive information. The solution integrates seamlessly with existing tools, creating a unified ecosystem for maximum productivity.

Key Takeaways

- Transforms raw data into immediate strategic advantages

- Provides real-time actionable business intelligence

- Features enterprise-level security protection

- Integrates smoothly with existing business tools

- Automates complex processes in compliance-heavy industries

- Reduces manual workload through intelligent automation

- Offers intuitive interface for quick user adoption

Introducing Focal AI: Transform Your Business Operations

How much productive time does your team lose to repetitive administrative work? Manual tasks drain resources and delay critical decision-making.

This intelligent platform redefines operational efficiency. It automates complex workflows that traditionally required human intervention. The system handles everything from meeting coordination to data processing.

Financial professionals gain remarkable time savings. Automated meeting preparation eliminates hours of manual work. Real-time transcription captures every detail without human effort.

Post-meeting follow-ups execute automatically. The entire process flows seamlessly from start to finish. Nothing gets missed or delayed.

Operational management becomes significantly more efficient. The platform handles multiple tasks simultaneously across departments. This creates unified oversight of all automated processes.

Transformation occurs at every operational level. Front-line client interactions improve through intelligent automation. Back-office compliance tasks execute with precision.

Time management improves dramatically. Administrative tasks disappear from professional workloads. Teams focus exclusively on high-value activities that drive growth.

The platform integrates seamlessly with existing business tools. CRM systems connect without disruption. Management software synchronizes effortlessly.

Businesses achieve complete operational overhaul. They accomplish what previously required multiple specialized systems. Everything consolidates into one powerful platform.

Enterprise-Grade Security: Our Foundation

How confident are you in your data protection protocols during digital transformation? Security isn’t an afterthought in our architecture. It’s the bedrock of everything we build.

Every layer of our platform incorporates military-grade protection. We prioritize security from initial design through final implementation. This approach ensures comprehensive coverage.

SOC 2 Type 2 Compliance with Active Monitoring

Our system maintains SOC 2 Type 2 compliance through continuous monitoring. Vanta provides real-time security validation around the clock. This ensures ongoing adherence to strict standards.

Regular audits confirm our commitment to excellence. The platform meets rigorous compliance requirements consistently. Businesses gain peace of mind with verified protection.

Microsoft Azure: The Most Secure Cloud Infrastructure

We operate exclusively on Microsoft Azure’s secure cloud environment. This infrastructure was specifically chosen for financial services needs. It offers unparalleled security capabilities.

Azure provides robust protection for sensitive information. The platform leverages enterprise-grade security features. This creates a trusted foundation for business operations.

End-to-End Encryption: AES-256 and TLS 1.2+ Protection

All data receives complete encryption coverage throughout its lifecycle. Military-grade AES-256 encryption protects information at rest. TLS 1.2+ protocols secure data during transmission.

This end-to-end approach ensures constant protection. No sensitive information remains vulnerable at any point. The system maintains encryption from capture through storage.

Firewall and VPN Protection Across Production Systems

Enterprise-grade Azure Firewall guards all production environments. Comprehensive VPN protection secures network operations completely. Multiple security layers work together seamlessly.

These systems integrate with existing organizational infrastructure. They maintain consistent protection across all operations. The platform exceeds industry standards for security.

Compliance-First Architecture for Financial Services

How many compliance challenges does your financial team face daily? Regulatory requirements demand absolute precision and transparency.

Our platform was engineered specifically for financial institutions. It handles complex regulatory environments with built-in safeguards. Every feature follows strict compliance protocols.

The system operates on transcription-only technology. It never records audio or video content. This approach eliminates privacy concerns completely.

All notetaking processes remain fully transparent. Bots are always visible during interactions. This ensures adherence to two-party consent laws nationwide.

Customer data receives maximum protection throughout. The architecture exceeds standard industry practices. Regulatory requirements are met without compromise.

Financial advisory firms gain powerful compliance management tools. The solution automates complex regulatory tasks. Manual oversight requirements decrease significantly.

Built-in checks operate throughout all workflows. They validate compliance at every process stage. This creates continuous regulatory assurance.

The platform meets FINRA and SEC requirements directly. It handles specific financial industry standards effortlessly. Institutions maintain compliance confidently.

Compliance forms the core foundation of our design. It guides every aspect of platform operation. Financial services receive dedicated protection always.

Seamless Integration Ecosystem

How many disconnected tools does your team use daily? Multiple systems create data silos and workflow bottlenecks.

Our platform solves this challenge through comprehensive connectivity. It creates a unified environment where all tools work together. This eliminates manual data transfers and duplicate entries.

The integration process is designed for immediate implementation. Users connect their existing systems with minimal configuration. Technical expertise becomes unnecessary for setup.

130+ Integrations Across Your Business Tools

Over 130 pre-built integrations await your business tools. These connections span across entire operational ecosystems. Popular software platforms integrate effortlessly.

Video meeting software connects automatically for transcription services. Zoom, Microsoft Teams, and Google Meet join sessions seamlessly. The platform joins meetings as a participant for accurate note-taking.

CRM synchronization happens in real-time. Customer data flows between systems without manual intervention. This ensures consistent information across all platforms.

User experience improves through intuitive connection setups. Single-sign-on capabilities simplify authentication across connected systems. Unified access management reduces login frustrations.

Automated processes synchronize data across multiple platforms simultaneously. Workflow automation extends through integration options. Businesses create customized solutions that fit unique needs.

The integration framework supports both common business tools and specialized applications. Financial services receive dedicated connection options. Every industry finds relevant integration possibilities.

Data flows securely between all connected systems. The platform maintains protection standards during all transfers. Business information remains safe throughout integration processes.

Streamlined Meeting Workflow Automation

How much valuable time slips away during manual meeting preparation and follow-up? Traditional approaches create unnecessary administrative burdens that drain productivity.

Our platform revolutionizes how professionals handle client interactions. It creates a complete automated workflow that transforms meeting efficiency. The system handles every aspect from start to finish.

Before Meetings: Automated Preparation & Client Overviews

The system automatically generates comprehensive client overviews before meetings begin. It prepares detailed meeting agendas without manual input. Pre-meeting emails dispatch automatically to all participants.

This preparation saves significant time traditionally spent on administrative tasks. Professionals arrive perfectly prepared for every interaction. The entire pre-meeting process becomes effortless.

During Meetings: Real-Time Transcription & Data Extraction

Real-time transcription captures every conversation detail accurately. The system simultaneously extracts actionable information during discussions. Structured data tables build automatically as meetings progress.

Important decisions and action items get identified instantly. The platform tracks commitments and follow-up requirements. No critical information gets missed during client interactions.

After Meetings: Automated Summaries & CRM Synchronization

Meeting summaries compile automatically when sessions conclude. Single-click synchronization updates CRM systems instantly. Forms populate automatically with extracted information.

Task delegation happens without manual intervention. The system manages post-meeting actions efficiently. This complete automation eliminates hours of manual work after every meeting.

Customer information flows seamlessly between systems. Data management becomes completely automated. The entire follow-up process requires minimal user interaction.

Time savings accumulate across multiple meetings. Professionals gain capacity for higher-value activities. Meeting workflow transforms from burden to advantage.

Omnichannel Transcription Capabilities

Are your meeting notes trapped in different formats across various platforms? This fragmentation creates information gaps and workflow inefficiencies.

Our platform captures conversations across every channel seamlessly. It handles video conferences, phone calls, in-person discussions, and recorded files. The experience remains consistent regardless of meeting format.

Transcription accuracy exceeds industry standards significantly. Advanced voice recognition identifies speakers correctly. It captures nuanced conversations with remarkable precision.

The solution handles complex financial terminology effortlessly. Industry-specific language gets transcribed accurately. This ensures reliable information capture every time.

Video meeting integration works automatically with popular platforms. Zoom, Microsoft Teams, and Google Meet connect seamlessly. The system joins scheduled meetings as a participant.

Phone call transcription requires no additional equipment. Simply add the dedicated number to any call. Automatic transcription begins immediately.

In-person meetings capture through browser or mobile microphones. Conference room conversations get transcribed clearly. Office settings work equally well.

Recorded files upload for instant processing. Historical meetings become searchable and actionable. Past information transforms into valuable insights.

Every meeting delivers comprehensive outputs automatically. Full transcripts, summaries, and action items generate post-session. The platform processes information for immediate use.

This omnichannel approach eliminates format limitations completely. Businesses gain unified conversation management across all channels. The experience transforms how teams handle meeting information.

Data Protection and Privacy Assurance

How secure is your customer information when using intelligent business platforms? Privacy concerns often prevent organizations from adopting new technologies.

Our solution provides comprehensive protection through multiple security layers. Every aspect follows strict privacy protocols from the ground up. This creates complete confidence in data handling.

Customer data never trains or fine-tunes our models. This ensures absolute confidentiality for all client information. The system maintains privacy through stateless processing.

Compliance with regulations includes full GDPR adherence. SOC2 compliant cloud servers handle all storage operations. These measures exceed standard industry requirements.

Information privacy remains protected through transcription-only technology. No audio or video recording occurs during any process. This approach eliminates privacy risks completely.

End-to-end encryption protects data throughout its lifecycle. Military-grade security covers transmission and storage. Information stays secure from capture through processing.

The platform ensures customer information remains private always. Access controls prevent unauthorized viewing or sharing. These measures provide complete assurance for sensitive data.

Compliance with privacy regulations is built into every operation. It forms the foundation rather than being an afterthought. This creates reliable protection for financial institutions.

End-to-end data protection meets financial industry standards. Secure transmission protocols and encrypted storage work together. These features maintain security throughout all processes.

Customer assurance comes from transparent handling practices. Clear documentation shows all privacy protection measures. Businesses gain confidence through visible safeguards.

Data deletion is permanent when information gets removed. No residual data remains in any systems. This ensures complete cleanup according to compliance requirements.

The platform delivers comprehensive protection for all sensitive information. Organizations can trust their data remains secure always. Privacy assurance becomes a fundamental advantage.

Industry-Specific AI Solutions

Are your financial operations struggling to keep pace with complex regulatory demands? The right technology platform transforms how institutions handle specialized requirements.

This platform delivers targeted capabilities for financial organizations. It addresses unique challenges in banking and investment services. The approach focuses on automation and compliance excellence.

Financial Services Automation

Manual tasks consume valuable resources in financial institutions. The platform automates repetitive workflows across departments. This creates significant efficiency gains.

Onboarding processes become dramatically faster. Some clients report over 87% reduction in processing time. The system handles documentation and verification automatically.

Ongoing compliance checks run in the background continuously. This ensures constant regulatory adherence. Financial professionals gain time for strategic work.

Customer Due Diligence Processes

Traditional customer screening requires extensive manual review. The platform automates due diligence completely. It processes customer information through intelligent verification.

Background checks and identity validation happen automatically. The system cross-references multiple data sources instantly. This ensures thorough customer assessment.

Risk profiling occurs without human intervention. The platform identifies potential concerns early. This protects institutions from problematic relationships.

AML Compliance Solutions

Anti-money laundering requirements demand precise execution. The platform’s compliance solutions meet regulatory standards efficiently. Automated monitoring happens around the clock.

Transaction analysis identifies suspicious patterns immediately. The system flags potential issues for review. This proactive approach prevents compliance problems.

Reporting generates automatically when needed. Documentation maintains audit-ready status always. Compliance management becomes effortless for teams.

Fraud Detection and Prevention

Financial fraud causes significant losses annually. The platform’s detection capabilities identify threats early. Advanced algorithms analyze patterns across systems.

Real-time monitoring catches unusual activity instantly. Alerts notify security teams immediately. This rapid response prevents financial damage.

Prevention measures integrate throughout all operations. The system learns from historical patterns to improve protection. Fraud risk decreases substantially over time.

Financial institutions gain comprehensive security coverage. The platform handles emerging threats effectively. Protection extends across all customer interactions.

Proven Results and Efficiency Gains

How much faster could your business grow with dramatically reduced processing times? The platform delivers measurable improvements that transform operational performance.

Financial institutions achieve remarkable time savings across multiple processes. Customer onboarding time reduces by over 87% using automated workflows. This acceleration directly impacts revenue generation capabilities.

User experience improves immediately upon implementation. Streamlined processes eliminate complexity and frustration. Teams adapt quickly to the intuitive interface.

Data accuracy increases significantly throughout operations. Automated systems reduce human error in information processing. Compliance reporting becomes more reliable.

The product generates valuable business insights automatically. Meeting content analysis reveals patterns and opportunities. Customer interactions provide strategic intelligence.

Operational efficiency extends beyond simple time reduction. Compliance accuracy improves while regulatory risk decreases. This creates comprehensive performance enhancement.

Time management transforms completely for professionals. Administrative tasks disappear from daily workloads. Teams focus exclusively on high-value growth activities.

Platform reliability ensures consistent performance across all functions. Minimal downtime maintains continuous operational flow. Technical issues become extremely rare occurrences.

Return on investment appears rapidly through multiple channels. Both time savings and risk reduction contribute to financial benefits. The experience consistently exceeds expectations.

Automated data processing delivers actionable business intelligence. Strategic decision-making improves with reliable information. Organizations gain competitive advantages through better insights.

Client Success Stories: Focal AI in Action

What results do real clients achieve with intelligent automation? Financial professionals across wealth management firms report transformative outcomes.

John Underhill from Acorn & Oak Wealth Management describes a “flawless experience” with accurate note-taking. Christian Battistelli at Assante Financial Management confirms the platform “complies with industry regulations” perfectly.

Jason Kane of Kane Company Wealth Management reports “reduces time spent tenfold” on administrative tasks. This time savings allows advisors to focus on client relationships.

Jason Pereira at Woodgate Financial calls it the “only solution for advisors” that truly understands workflow needs. Paulina Hadjiyianni from IPC Securities appreciates how the system was “thought through advisor-specific workflows.”

Trent MacKeen at First Wealth Advisors highlights the security advantage: “not built on google infrastructure.” This provides additional protection for sensitive client information.

Marc Ruemmler from Stonepath Wealth Management notes “better notetaking” and summaries that are “easier to quickly reference.” Spencer Davies confirms output is “very relevant and easy to understand.”

Aaron Parrish at Level Wealth Management values how the platform captures essential details without overwhelming users. The system filters unnecessary data while retaining critical information.

These testimonials demonstrate consistent praise for reliability and accuracy. The customer experience remains outstanding across different firm sizes.

Implementation support receives frequent mention. Professional account management guides clients through setup and optimization. Subject-matter expertise ensures maximum platform utilization.

Real-world performance exceeds expectations for most advisors. The solution delivers on its promises for time reduction and compliance assurance.

Why Choose Focal AI Over Competitors

Not all automation platforms offer the same level of protection for sensitive financial information. The focal difference lies in security architecture and compliance capabilities.

This solution operates exclusively on Microsoft Azure’s secure cloud infrastructure. Competitors often use less specialized hosting environments. Financial services receive enterprise-grade protection that others cannot match.

Transcription-only technology ensures complete privacy compliance. No audio or video recording occurs during any process. This approach eliminates regulatory concerns that plague other systems.

Visible notetaking bots maintain transparency throughout all interactions. They ensure adherence to two-party consent laws nationwide. Strict access controls prevent unauthorized sharing of meeting notes.

The platform delivers superior note quality with dynamic summaries. These are specifically tailored to financial conversations. Client interactions receive more accurate documentation than competitor offerings.

Beyond basic transcription, the solution provides comprehensive workflow automation. It handles task management, follow-up emails, and meeting preparation. Note search capabilities and automated processes create complete operational efficiency.

Integration with existing business systems happens more seamlessly than competitor platforms. The architecture creates a unified environment rather than isolated features. This end-to-end approach delivers more value than partial solutions.

Continuous innovation focuses specifically on financial advisor needs. The development roadmap addresses industry-specific requirements proactively. This maintains competitive advantages that general-purpose platforms cannot match.

Compliance features exceed what other providers offer. Built-in safeguards address financial regulations directly. Institutions gain peace of mind with verified protection measures.

The complete security architecture provides assurance that competitors lack. From infrastructure to access controls, every layer receives specialized attention. Financial organizations choose this platform for comprehensive protection.

Conclusion: Elevate Your Business with Focal AI

Ready to transform your operations with cutting-edge technology? Focal AI delivers the tools you need for smarter decision-making and seamless workflow management.

Our platform turns complex data into clear, actionable insights. It automates tedious tasks so your team can focus on growth. The system handles everything from compliance to client interactions with precision.

Experience end-to-end security that meets strict industry standards. Your information stays protected while gaining valuable business intelligence. This approach ensures both efficiency and peace of mind.

Adopt a solution built for real-world needs. Elevate performance, reduce manual work, and unlock new opportunities effortlessly.

FAQ

How does Focal AI handle data security and privacy?

Our platform uses enterprise-grade security protocols, including end-to-end encryption, SOC 2 Type 2 compliance, and Microsoft Azure’s secure cloud infrastructure. All customer information is protected with AES-256 and TLS 1.2+ encryption.

Can Focal AI integrate with my existing systems?

Yes. Our solution offers over 130 integrations with popular business tools, ensuring seamless data flow and management across your entire tech stack without disrupting your current workflow.

What kind of insights can I expect from the platform?

Focal AI delivers actionable insights through real-time transcription, automated summaries, and data extraction. This helps improve decision-making, customer experience, and operational efficiency.

Is Focal AI compliant with financial industry regulations?

Absolutely. Our architecture is built with a compliance-first approach, specifically designed for financial services. We support AML compliance, fraud detection, and customer due diligence processes.

How does the meeting automation feature work?

The meeting workflow includes automated preparation before meetings, real-time transcription during sessions, and automated summaries and CRM sync afterward. This saves time and enhances accuracy.